To make GST payment Challan online, GST payment challan must first be generated from the GST portal. When the payment challan is generated, then the payment can be done by internet banking, credit/debit card, NEFT, or cash payment at designated banks.

CREATE GST PAYMENT CHALLAN ONLINE:-

Here, we will discuss how you can create GST payment Challan online:-

- First, log in to GST portal website. Insert the Username, Password, and Captcha Code.

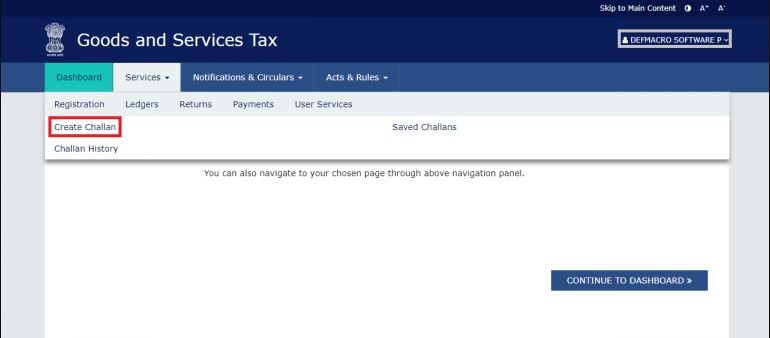

2. When you are logged into your account, then go to the services and tap on payments and click on create challan option.

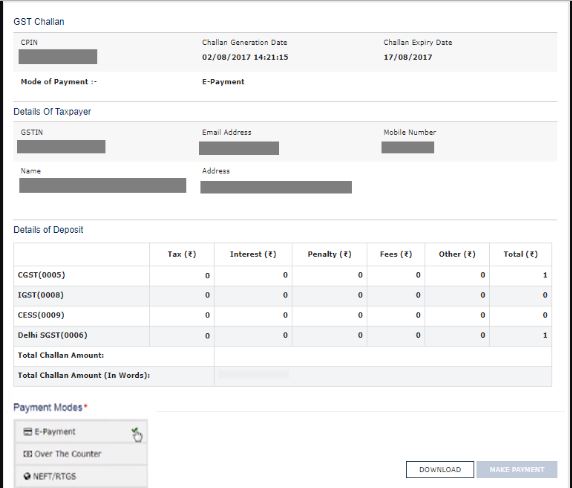

3. Now enter the amount payment and choose the method of means e-challan over the payment method which you want. When all the details are filled in then tap on the Generate Challan.

The payments method you can choose are the following:

- Internet banking and credit/debit cards of authorized banks

- Over the counter payment through authorized banks

- Payment through RTGS/NEFT from any bank

For payment over the counter payment through authorized banks, there is a limit of RS 10,000.

4. Then you will see a summary page which contains all the details of the Challan. Now choose a payment method among the three which we have discussed in the previous step to create GST payment Challan online. Tap on the “Make Payment” option.

5. Create an online payment of GST through Net-Banking or take a printout of the Challan and create a payment in Bank.

When the payment is made, then you will receive a Challan which contains all the details of the tax paid. Then the tax paid Challan (CIN) will be credited to the cash ledger account of the taxpayer.

These are the ways to create GST Challan payment online. If you have any question regarding this, then free to message us in the comments section.